Retirement Planning:

Retirement planning is the process of deciding the goals to pursue after retirement and the roadmap to achieve those goals .You no longer receive a paycheck once you retire and thus have to rethink a few things. You have to do assess where will the income come from, how you will meet your expenses etc., how much are your savings etc. All these things makeup the term retirement planning.

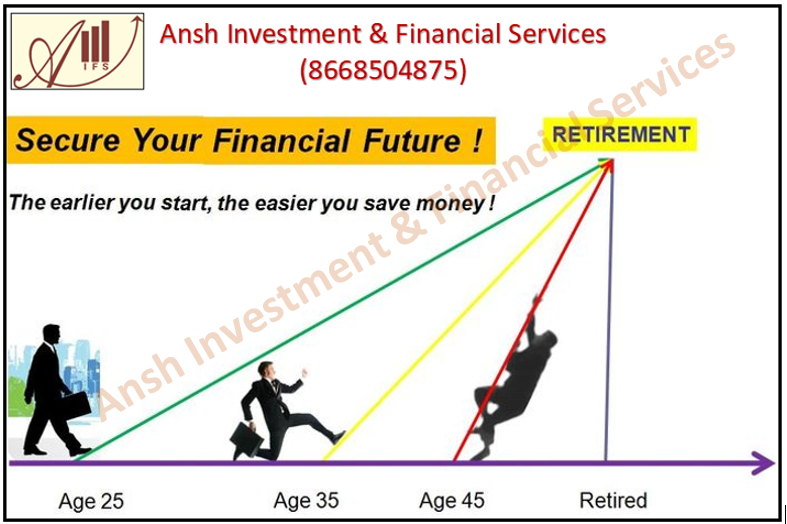

Though no time is perfect, you should start planning for retirement as early as you can. The earlier you start planning for your finances the better it will be for you once you reach the retirement stage.

Need of Retirement Planning:

A comprehensive retirement planning can help you stave off the worries of inflation and living cost during your golden years .Key to a fulfilling retired life is to open early and use the best pension plans possible to achieve your goal.

Retirement plan- An essential need, because:

- Increasing life expectancy

- Increasing inflation

- The interest rate on investment is falling

- Protect post-retirement lifestyle

- Protection of spouse/ dependent

- Collapse of joint family structure

- No proper social security system

Effect of inflation:

If there is an increase in the pension after retirement, then it is not a matter of that much concern, but if there is no increase then it is a matter of concern.

Example: Assume that:

- Pension => Rs.50,000 per month

- Expenditure => Rs.35,000 per month

- Inflation rate => 6% p.a.

According to calculation, after 7th year you will need Rs.52, 627 for expenses whereas your pension is only Rs.50, 000 per month.

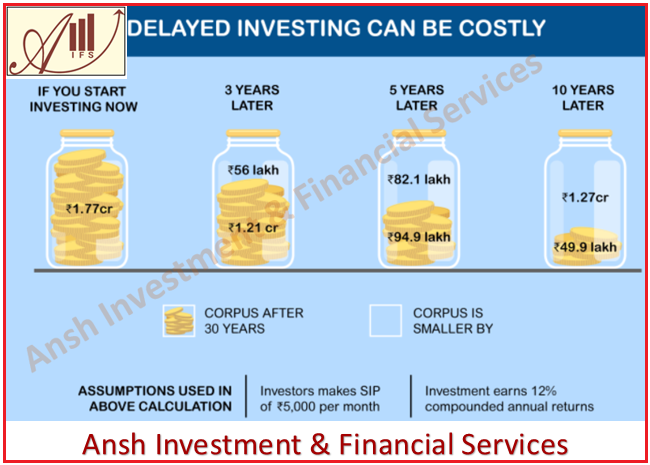

Cost of delay:

If you start investing late under retirement planning, then your troubles will increase.

Retirement funds are also less as a result of starting investment late:

Types of Retirement & Pension Plans in India:

1. Immediate Annuity :

An annuity is payable immediately, as per payment frequency chosen, at a constant rate in arrears . Premium is paid in lumpsum at beginning of annuity plan.

These are pension plans more than investment plan for retirement. These plans are best used near or after retirement, once you have accumulated your retirement fund.

2. Deferred Annuity:

An annuity is payable post deferment period, as per payment frequency chosen, at a constant rate in arrears. Premium is paid in lumpsum at beginning of annuity plan.

Your investment continues to grow while you wait for the annuity to start in the deferment period.

3. With Cover Pension:

This pension plan includes an insurance cover that entitles your dependents to a lump sum amount in case of an unfortunate event.

Such plans are best for you if your spouse is financially fully dependent on you.

4. Without Cover Pension:

In case of unfortunate event this plan gives pension to your nominee (as conditions chosen by you)

There is no life cover (Sum assured) in these plans.

5. Unit-linked Pension Plan:

Your premiums are invested in a combination of stocks, bonds, & securities depending on your risk appetite, to build a corpus that is paid out at maturity.

These plans are great for long-term corpus growth. So, if your risk appetite and age allows for equity exposer use Unit-linked pension plans to build your retirement funds faster.