There are several investment options in India, where one can get regular income. Some regular income plans are high risk and some are safe investment options. Some provide guaranteed returns, while some provide regular income, though not guaranteed. Each one has its own pros and cons.

Who would require regular income?

Before we jump into the investment plans that provide regular income, let us quickly check who would really require such regular income:-

1.In the old age or after retirement, comes the phase when the people become feeble and unemployed. They keep thinking how to get regular income from investments in India. That time they look for investments that can provide them with steady and regular income. This helps them to plan their financial requirements and restructure them accordingly.

2.There are even many other investors who might want to invest a lump sum and get a regular second income apart from their salary or business income.

Investment options for regular income :

Mainly it’s divided in two categories:

A. Safe investment options:

1.Senior Citizen Saving Scheme in Nationalized Bank or post office ( TAXABLE )

2.PMVVY ( Closed from 31st March 2023 ) in LIC

3.Monthly Income Scheme in Post office ( TAXABLE )

4.Regular Income Plan for life long with cover ( TAX FREE )

5.Regular Income Plan for limited period without cover ( TAX FREE )

B. High Risk Investment options:

1.SWP from mutual fund

2.ULIP pension plans

Senior Citizen Saving Scheme:

A special saving scheme is offered by the Bank/ Post Office of India for the senior citizens ( above the age of 60 Years ) known as Senior Citizen Saving Scheme . It is a risk free investment instruments that offers excellent returns:

1.Maximum limit of investment is Rs.30 Lakhs.

2.Maturity periods is 5 years . After maturity one can extend for another 3 years.

3.Premature closure is allowed after one year, but after the deduction of certain percentage of the interest rate.

4.Interest Rate is 8.2% (interest rate is reviewed quarterly) Interest Amount is paid on a quarterly basis, credited in saving account present in the same deposit office.

Monthly Income Scheme:

This is suitable for those who expect to receive regular and guaranteed income on a monthly basis.

1.Backed by the Government of India, operated by Post Office.

2.Safe & guaranteed investment option.

3.Maximum investment limit for single is Rs.9 Lakhs and for joint is Rs.15 Lakhs.

4.The Maturity period of this scheme is 5 years. However, one can withdraw earlier after the completion of one year of deposit with a certain percentage of deduction in interest rate.

5.Current annual interest rate is 7.40% (Compound interest is not applicable for this scheme) .Monthly interest credited into savings account present at the same Post Office.

Regular Income Plan for life long with cover:

A regular income plan is an investment plan that provides a steady stream of income regularly. You invest a fixed sum regularly over a specified period. This money is grows over time. After the maturity of the plan, you receive the returns as a fixed income for a predetermined period of time.

This plan is providing life insurance with regular benefits as well as maturity benefits.

Things to consider before buying a regular income plan:

1.Assess Your Requirements:

Different schemes offer different benefits. These plans have different entry ages, premium paying terms and payout options. Assess your family’s needs and choose the best regular income scheme keeping in mind your immediate needs and your long term goals.

2.Income Amount Needed When You Retire:

You can use the monthly income from these plans as a pension to secure financial independence once your regular earning stops. But first, you must estimate the funds needed to cover for your expenses after retirement. This will enable you to buy a suitable plan offering a sufficient income.

Let us try to understand regular income plan with an example:

Scenario “A” where investment amount is fixed:

Assume that Mr. A is 30 years old and he decided to deposit Rs.2, 40,000 per year to get pension / regular income with life cover:

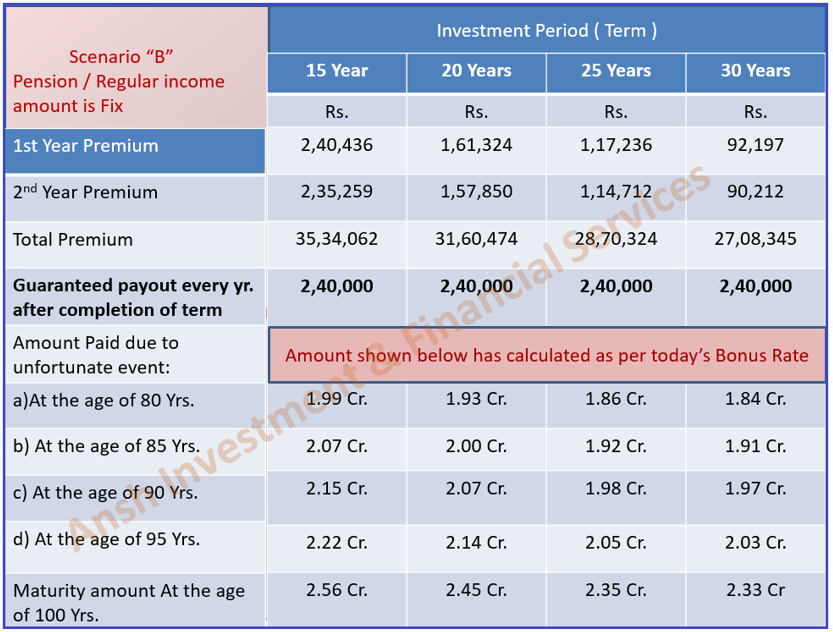

Scenario “B” where pension amount is fixed:

Assume that Mr. A is 30 years old and he decided to get Rs.2, 40,000 per year as pension / regular income with life cover:

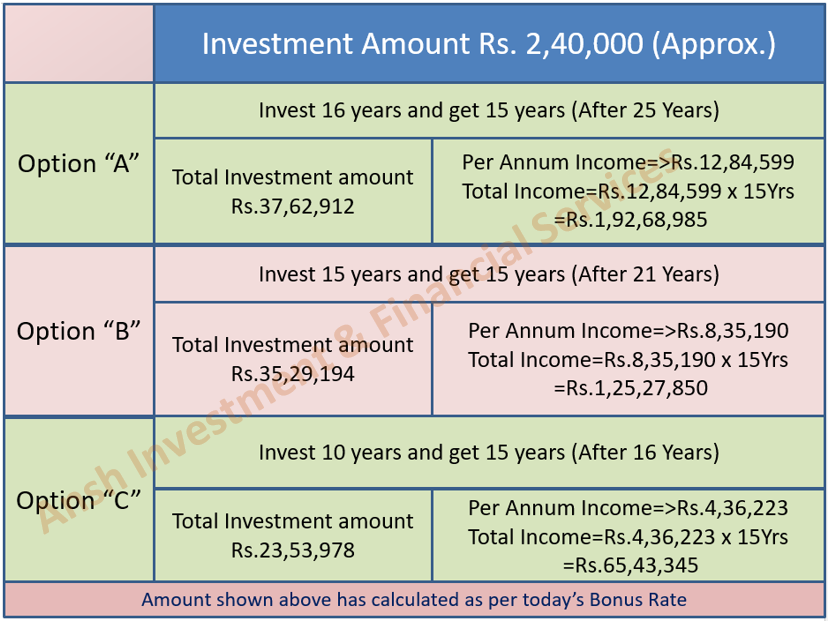

Regular Income Plan for limited period without cover:

These type of plans provide regular income only for a limited period and life cover is not available during this period.

Let’s understand it with an example:

Assume that Mr. A is 30 years old and wants to get regular income for a limited period and for this he invest Rs.2, 40,000 per annum.

Apart from the above, there are other investment plans which provide pension/ regular income for a limited period of time without life cover.

SWP from mutual fund:

A systematic Investment Plan (SIP) allows an investor to invest a fixed amount at pre-determined intervals and a Systematic Withdrawal Plan (SWP) is a facility which allows an investor to withdraw a fixed amount at pre- determined intervals.

Just like one can systematically invest in mutual funds plans, he can also set up a systematic withdrawal plan to receive a stream of regular income from investment every month on a fixed date. It can be a fixed or a variable amount. It is typically used on retirement and allows investors to withdraw monthly, semi-annually, quarterly, or annually.

Understanding Systematic Withdrawal Plan (SWP)

A systematic withdrawal plan is the opposite of SIP. It allows you to create a series of receivables from your mutual fund investment regularly on a pre-decided date. Unlike lump-sum withdrawal, SWP will enable investors to customize withdrawal from the corpus in a phased way.

You can withdraw the capital gain or a fixed amount, whereas the residue gets reinvested in the scheme. This way, you can stay invested for a long time and receive a regular income.

Let’s understand with an example.

Suppose you invested Rs 10,00,000 in a mutual fund for one year and decided to withdraw Rs 10,000 per month. So every month, your investment amount will get reduced by Rs 10,000 and paid to you. The remaining amount after each month will continue to generate returns from the investment.

Key features of an SWP

1.Flexibility:

SWP allows investors to select the amount, date, and frequency to receive income from an SWP. Also, one can stop it at any time.

2.Regular income:

SWP lets mutual funds investors receive a steady income from their investment. Hence, investors needing a stable cash flow for meeting everyday expenses, like the retired investors, can invest in SWP schemes.

3.Capital appreciation:

The regular withdrawal is less than the returns earned from the investment. Hence, the investors get some capital appreciation in the long run.

4.No TDS:

There is no TDS deducted on SWP for resident investors.

Who can invest in an SWP?

(a)Investors wanting to create a secondary source of income:

Investors use SWP to create a secondary source of income from their long-term investment. It helps ride over the rising cost of living.

(b)Investors looking for capital protection:

Investors who prefer protection over returns can invest in low or medium-risk mutual funds and receive the capital gain as a regular fixed income.

(c)Investors need a retirement income:

Investors can use an SWP scheme as a pension income by investing a retirement corpus in mutual funds. They can select a scheme based on their risk appetite and the frequency to receive payment from the capital gain.

(d)Investors in the high tax bracket:

Individuals at the higher tax bracket can invest as there is no TDS deduction on investment. The capital gain from the equity funds are also moderately taxed.

How can you withdraw from SWP?

SWP in mutual funds allows investors to customize their withdrawal plans. Individuals can receive a specified amount monthly, half-yearly, quarterly, or annually. You can withdraw only the appreciated amount with appreciation withdrawal while your principal amount remains invested to earn returns.

How does an SWP work?

One important thing to understand is that SWP isn’t quite like a fixed deposit. With a fixed deposit, your principal amount remains unaffected by market fluctuations. But, for SWP in mutual funds, the NAV value fluctuates with the rise and fall in the market, impacting your investment’s final value. It also reduces by the number of units redeemed with every withdrawal.

Example:

Assume that:

- You have 1000 units in mutual fund.

- You wish to withdraw Rs.5000 monthly

- 1st month if the NAV value Rs.10 then you need to redeem (Rs.5000/NAVRs.10) 500 units to receive Rs.5000.

After redemption you have (1000-500) 500 units.

- 2nd month if the NAV value Rs.25 then you need to redeem (Rs.5000/NAVRs.25) 200 units to receive Rs.5000.

After redemption you have (500-200) 300 units.

Key takeaways

(1)A systematic withdrawal plan allows investors to customize and create a second income stream from their mutual fund investment.

(2)Investors receive returns on a specific date either by a fixed amount or variable.

(3)Investors who don’t receive a pension can use SWP as retirement income.